The Renewable Heat Incentive

The Renewable Heat Incentive, or RHI, was announced in 2008 as part of the Energy Act, although it didn’t come in to effect until 2014. It’s a government subsidy designed to reward smallscale renewable heating systems across England, Scotland and Wales. There’s a commercial arm to it as well, but we’re drilling down on the Domestic RHI in this article.

Biomass Boilers

Biomass boilers do exactly what they say on the tin; they’re just like your run-of-the-mill gas boilers, except they run from burning biomass (small wood pellets or chips). This fuel source is considered carbon neutral because even though it gives off carbon dioxide, this is the CO2 that it’s absorbed during the lifespan of the plant (photosynthesis). Therefore it isn’t adding any extra carbon to the atmosphere.

Step One: Annual Heat Demand

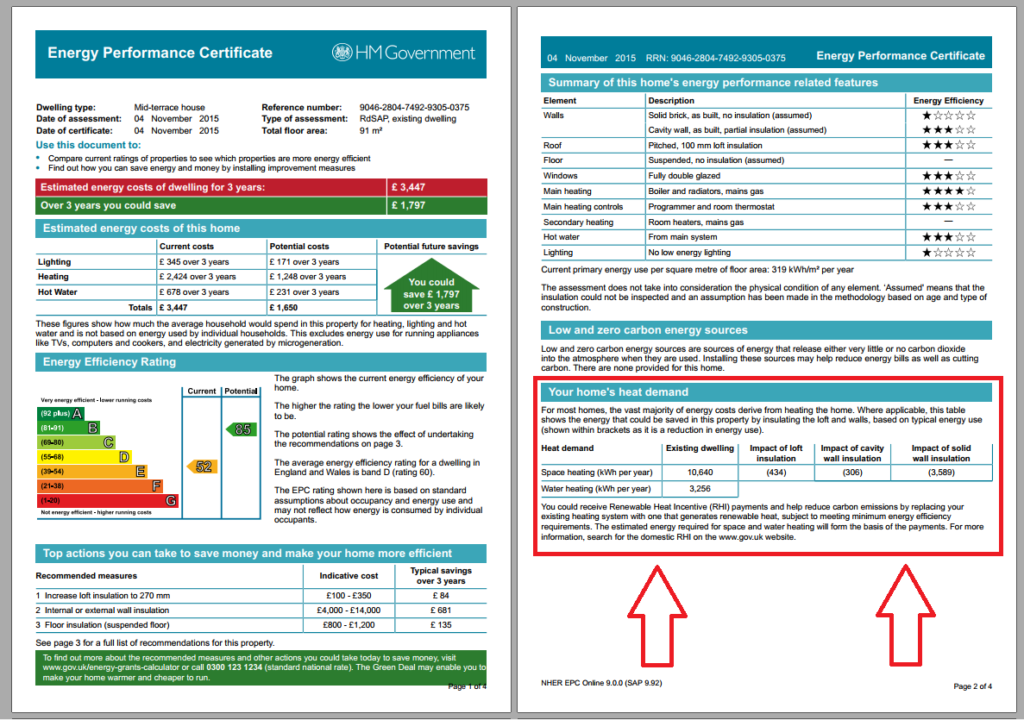

Find the annual space heating and/or hot water demand for your home on your EPC. If you don’t have an EPC, get one now as you’ll need it to apply for the RHI anyway. You can find the section on heat demand towards the bottom of the second page of your EPC.

Depending on whether you’re looking to use your biomass boiler for heating or hot water, you either take the top or bottom number, or add the numbers together if you’re planning to use the boiler for both. The number you’re left with is your home heating demand (measured in kilowatt hours per year, or kWh).

Since 2017, the annual heat demand for RHI applications has been capped at 25,000 kWh. If your heat demand is above that, your payments will still be calculated on the basis of 25,000 kWh.

Step Two: RHI Tariff Rate

The Renewable Heat Incentive tariffs are not permanently fixed, but rather they are review every 6 months by the Department for Business, Energy & Industrial Strategy (BEIS). This can lead to adjustments, known as degression. Theoretically, degression can alter the tariff by up to 20% in one swift move. There may also be adjustments in line with the Consumer Price Index (CPI), designed to allow for national inflation. However, since the rates were raised at the beginning of 2018 (following the implementation of a heat demand limit), there’s been very little change.

Your payments will be set at the tariff rate that was applicable on the date of your application.

Step Three: Calculating Quartlery, Annual, and Total Repayments

So, now that we have all the numbers we need, it’s pretty simple to figure out the payments we can expect.

First we have to divide the tariff rate by 100 to get it into a standard currency format, as opposed to pence. So the 6.88p tariff rate becomes £0.0688.

Annual Payments:

Multiply the above standard format tariff rate by your annual heat demand. Simple!

Quarterly Payments:

Divide your annual payments by 4.

Total RHI Payments:

Multiply your annual payments by 7.

We’ve put some examples below of how different heat demands create

| Building | kWh | Quarterly Payment | Annual Payment | Total RHI Payback |

| Small house, good insulation | 8,000 | £137.60 | £550.40 | £3,852.80 |

| Medium house, average insulation | 12,000 | £206.40 | £825.60 | £5,779.20 |

| Large house, poor insulation | 25,000+ | £430.00 | £1,720.00 | £12,040.00 |

Think we missed something? Do you have a different opinion?

Comment below to get your voice heard…

Does this also apply to log burning stoves? Even though they’re being removed from London?