A Few Oil Basics

Today, almost everyone is reliant on oil in some way or another. Many of us rely on petrol cars and buses to get to work as well as taking flights to go on holiday.

However, there are 1000s of other products we use daily that are derived from crude oil including: plastics, synthetic rubbers, cosmetics, perfumes and industrial solvents to name but a few. Petroleum is also key when making fertilizer, so the cost of food is indirectly linked to the cost of the black stuff too!

At today’s prices, if you were to buy one barrel of crude oil it would cost you about $100 dollars. One barrel is equal to 42 US gallons, which is just shy of 159 litres.

Unfortunately you can’t simply take the oil from the ground and use it in a car, plane or bus. First it needs to be refined, this actually produces numerous other products that we use today – below I have split out the main products that you can get from one barrel of oil:

73 litres of petrol

40 litres of diesel / heating fuel

16 litres of Jet fuel

6 litres of Liquid Petroleum Gas

+ small quantities of numerous other products like lubricants, kerosene and asphalt.

If you add up the volume of all the products from refining a barrel of oil, you actually get about 10 litres more than is put in, due to what’s called the ‘processing gain’ which results from processing and chemical changes decreasing the density and hence increasing the volume of the refined components.

Why The Government Love Petrol

People might be struggling to pay for the price of petrol now, but for the Government it is an absolute gold mine.

If you fill your car with £50 of fuel, the Government will get £30.

(1 litre of unleaded petrol in the UK currently costs about £1.37, with the Government getting about 60%, the petrol itself accounts for 34% and the other 6% covering the refining costs and the retailer margin.)

In total the UK Government estimated that it would bring in £592 billion worth of revenue from various taxation (income tax, corporation tax, VAT etc.) during 2012/13. It calculated spending of £683 billion on social welfare, the NHS, education and defence etc. Now you can see there is an issue here – they are short by just under £100 billion. This deficit is what the Government are trying to bring under control.

They have a challenge trying to balance the books while not increasing fuel duty too much to choke off demand. So, bringing this back on topic, what is the effect of fuel on the tax receipts?

Well via fuel duty, the Government get about £27 billion a year and the VAT element of the fuel gets them a further £10 billion. So fuel makes them about £37 billion of the £592 billion worth of revenue they are expecting (or in percentage terms 6.25%).

Based on the fact the Government are already under enormous pressure to cut the deficit, it seems to TheGreenAge, they are absolutely reliant on the petrochemical industry contributing to tax receipts.

A Bit of History

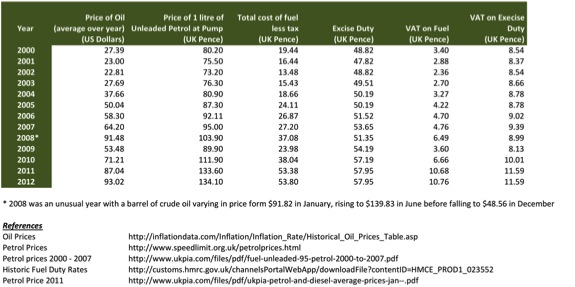

Back in 2000, fuel cost about 80p per litre from the petrol forecourt, made up of £0.48 of duty and £0.12 VAT. This meant the Government at this point in time were receiving over three quarters of the total cost of fuel back via taxes.

The ridiculously high duty prices led farmers and lorry drivers to block oil facilities leading to massive petrol shortages across the UK.

The cost of a barrel of oil in 2000 was ‘only’ $27 (remember it is now just shy of $100)

In 2007, oil prices had increased to $64, and this saw fuel prices in the UK exceed £1 per litre for the first time. This again led to blockages of oil facilities, but not to the same extent as in 2000.

In the summer of 2008, oil prices reached a record $140 per barrel and this saw fuel prices reach £1.20 per litre of petrol and £1.33 per litre of diesel, but by the end of the year the prices had dropped back to sub £1.00 for both as a barrel of oil dropped to $48.

Since 2008, despite a global recession, the value of oil has been steadily increasing and is now approaching the $100 a barrel mark.

You can see in the table below all the numbers discussed above, and hopefully appreciate why it paints a scary picture. The price of oil is likely to continue to increase. As the Government is under pressure to increase tax receipts the duty and VAT is unlikely to decrease. These two factors will drive the price of fuel up, which will directly hit the pockets of consumers.

The average car in the UK has a 65 litre fuel tank, which to fill up at today’s prices costs about £87. Ten years ago, an equivalent tank would have only cost £47 to fill up.

There are stabilisers in place (enacted the Treasury) to prevent the price of fuel mirroring the erratic changes of crude oil. Unfortunately, if prices of crude continue to increase, no government stabiliser will be big enough to offset the price rises in petrol.

What is Causing the Price of Crude Oil to Increase?

There are several interlinked reasons why crude prices are increasing. The first is that while demand continues to grow (as the worldwide economy recovers and China continues its 10% + growth), supply is failing to grow at the same rate. Oil comes from many different places, but much of it is concentrated around the Middle East and Northern Africa, which has seen much political unrest in recent times. This has led to worries about supply interruption, which of course leads to short term spikes in oil prices.

There have been very few significant oil finds in the last few years. The super oil fields in Saudi Arabia are now over 50 years old, and while there is still plenty of oil in them, the oil coming out tends to be polluted with water so is less valuable (the water is used to keep the pressure up in the well). It has been speculated that we have even reached ‘peak oil’, ie reached a maximum global output of oil. No matter what new technologies we develop to get the oil out of the ground, it is highly unlikely to come out at the rate and volumes it once did.

In addition, much of the oil in existence today is not in the easy to use form that you see flying out of oil wells in cartoons, instead it is held within oil sands, or it is much deeper in the ground. Wells will need to be dug significantly deeper, therefore the price of extracting the oil is now significantly higher than previously.

High oil prices can also be driven by a number of external events, for example when things go wrong in the stock markets. In 2008 we saw the housing market in the US burst; this resulted in a large sell off of traditional shares and savings bonds. People then moved a large amount of money from those investments to commodities like oil and gold. This event resulted in a massive spike in the price of oil, driving it up to $140 a barrel.

There is a potential saving grace on the horizon in the form of shale oil, but I am not going to give my two pennies worth on this until more research has been released on the environmental impacts of fracking.

Impact of Oil hitting $200 a Barrel

So taking this into account, what would be the impact of crude oil hitting $200 plus? Petrol could work out somewhere between £2.50 and £2.80 per litre, a pretty harrowing picture for consumers.

I began this blog by saying that in 2013 people are struggling to pay for fuel. I used to have a car, and it cost about £70 to fill up the tank, which lasted about a week and a half. I sold it. It was not worth it; my bike gets me around for free (aside from the food I need to eat to power it!).

I assume the thought of filling up a car for £180 or more fills most of you with dread (£2.80 multiplied by average 65 litre fuel tank). When household budgets are already tight, and with water and other utilities surely going to increase too, this might be too much for many people.

I appreciate that for many people cycling is simply not an option, but there are a growing group of people out there who will not use their car if there is only person in it. Can we change the culture in the UK, working to improve our budgets and health.

The True Cost of Oil

If you calculated the ‘work’ that can be carried out using the energy in one barrel of oil and compared it to the equivalent amount of work that a human could do, it would take a human about 10,000 hours to complete the same amount of work (based on the assumptions here. If you then take an average hourly wage of $6.60, then oil should be worth $66,000 a barrel (if you just took the UK, with an average wage of $20, then it would be worth $200,000 a barrel).

Maybe, if we really appreciated what oil does for us and the bargain price that we pay for it, we perhaps wouldn’t be quite so frivolous and drive 500m to the newsagent to buy a pint of milk.

References

http://www.theaa.com/motoring_advice/fuel/aa-fuel-price-review-2008.html

http://www.hmrc.gov.uk/

http://inflationdata.com/Inflation/Inflation_Rate/Historical_Oil_Prices_Table.asp

No Comments yet! Be the first one.