The Green Deal was the Governments flagship energy saving program here in the UK. It ran for a couple of years and despite being simple in principle – the energy savings produced from installing a measure are used to cover the install cost – when you actually got down to the nitty gritty there were a few simple reasons the scheme failed. Firstly the interest rate was too high, the application process was painful to go through for the customer and tough to calculate for the Green Deal providers and ultimately the amount of finance often made available was insufficient to cover the install costs of some of the energy saving measures. As a result the scheme was killed off by OFGEM in late July 2015, just two and a half years after it was launched.

In this piece we are going to examine exactly why the scheme failed (building on the points above) and look into what the Government could do for their next big energy saving scheme! All of what you are about to read is based on the thousands of Green Deal reports we carried out across London – we changed our approach as the scheme went on as we learnt more about the failings of the scheme in an effort to help people avoid paying for what would be a wasted visit but at the beginning we had no idea what to expect since what we had been taught in the classroom was far different from how it worked out in reality.

The Green Deal Interest rate was too high

The interest rate was set by the Green Deal finance company at 6.96% at the start of the scheme and this we think put a huge number of people off. We actually think it was quite impressive that the Government tried to set this up as a commercial venture (i.e. the Green Deal Finance company was formed to run the finance side of things), but in reality this high headline figure was a real turn off.

With mortgages at record lows, and bank loans available at a far lower rate too the prospect of taking a loan out for 25 years at 6.96% just doesn’t sit with the majority of people. In TGDFC‘s defence, the rate on a 25 year fixed loan is hugely difficult to calculate since underlying interest rates could go up significantly over that time span – even a fixed mortgage available now tends to be fixed for a maximum of 10 years since trying to guess what is going to happen past that length of time is incredibly difficult. Fixing something for 25 years has a huge element of risk attached to it, so the interest rate that was chosen (the 6.96%) needed to be higher to reflect this risk.

The Green Deal didn’t help those in real energy poverty

The Green Deal finance company did try their best to lower the credit score rating requirements to access Green Deal finance. The issue here was that even having a credit score requirement in the first place meant some people would be unable to access this scheme.

Without trying to generalise too much – a major issue is that these are the people that needed the Green Deal finance the most. Again it is credit risk and the Green Deal finance company simply couldn’t afford for people not to be able to keep up with their repayments – but immediately you are shutting out a large proportion of people who would of benefitted hugely from the scheme.

Fixing the finance to the house instead of a person

Green Deal finance was unique, because the Green Deal finance was attached to the electric meter, not the person who took out the Green Deal finance plan on their home (or the home they were living in if tenants).

This is perfectly sensible in practise – what it means is if you were to get a boiler installed, but sell the house three years down the line, you would only pay for the 3 years use you get out of the boiler. The new owner of the property would take on the remaining debt, but importantly they would benefit from the new boiler and its increased energy efficiency. The issue of course is that why would someone move into a house with Green Deal finance – you had no say in getting the new boiler or the solar PV. This is an additional outgoing, even if the the previous occupant had installed it and the energy bills are lower as a result. Moving into a home with yet another monthly cost just isn’t attractive and we had a huge number of people who were very nervous about taking out Green Deal finance for exactly that reason.

The Green and orange ticks on the Green Deal Report

When our assessors all went through the Green Deal training, we were all explicitly told that the if there was a Green tick next to a measure on the Green Deal report, the measure would be fully covered by Green Deal finance. If there was a Orange tick then it would be partially funded by Green Deal finance.

To set the record straight this simply isn’t true – but until The Green Deal Finance company put in place the ability for homes to get Green Deal finance, some six months after the Green Deal was launched and we started carrying out surveys we just weren’t able to know this. We had to go on what the Government had told us, hence we told our customers exactly this, but it wasn’t the case.

In fact the colour ticks mean nothing! We carried out thousands of Green Deal reports and whether an energy saving measure could be fully funded was all down to the size and age of the property and the efficiency of the heating system. So how exactly was the finance calculated?

Firstly the lifespan of the measure needed to be established. This wasn’t actually how long the thing was going to last in the home, instead it was the length of time over which the Green Deal finance company would provide you with the finance.

Take for example cavity wall insulation – according to DEFRA, if you get cavity wall insulation installed today in your home it will last 42 years – so that is the length of time it will last before the energy saving properties begin to diminish.

In terms of green deal finance though, the Green Deal Providers wouldn’t offer the finance over 42 years – instead it was capped at 25 years. It was this lower number that was used to calculate the finance. In the table below you can see the different finance life spans for the main green deal measures

Measure Finance Lifespan

Condensing Boiler 12

Heating controls 12

Under-floor heating 25

Heat recovery systems 20

Mechanical ventilation (non-domestic) 25

Flue gas recovery devices 12

Cavity wall insulation 25

Loft insulation 25

Flat roof insulation 20

Internal wall insulation 25

External wall insulation 25

Draught proofing 10

Floor insulation 25

Heating system insulation (cylinder, pipes) 10

Energy efficient glazing and doors 20

Lighting fittings 25

Lighting controls 25

Innovative hot water systems 25

Water efficient taps and showers 25

Ground and air source heat pumps 20

Solar thermal 25

Solar PV 25

Biomass boilers 20

Micro-CHP 15

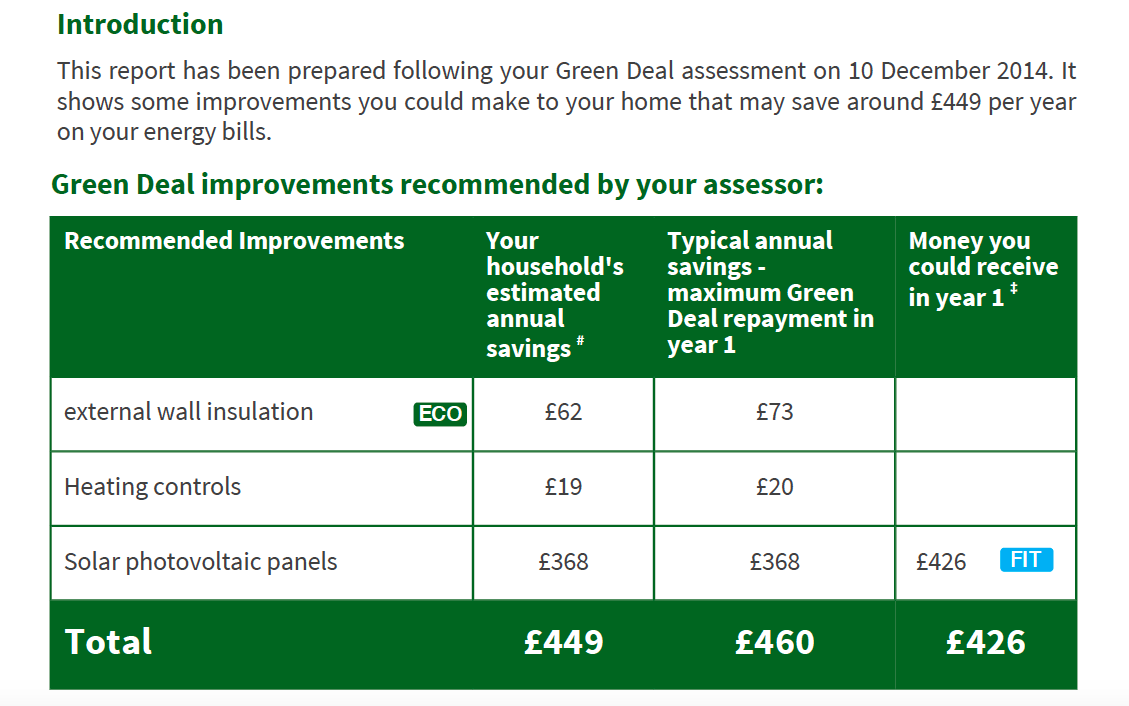

Once you have the finance lifespan, you then needed to take the Typical Annual savings directly from the Green Deal Report – This could vary hugely, but say for example solid wall insulation on the report below had a typical annual savings number of just £73.

If you took this number and multiplied it by the lifespan it gave the total amount of finance the Green Deal Provider would be able to offer to get the energy saving measure installed – so in this case £73 x 25 years which equals £1,825.

This doesn’t seem too bad – £1825 – however this includes the interest…

The Total Finance you can get includes the interest on the loan

The total finance number (e.g. £1,825 in this case) included both the interest and the amount that could be used to help cover the cost of the works. In the case of solid wall insulation which was a 25 year measure under the Green Deal, the interest : capital ratio was approximately 55% : 45% – so for £1,825 you would actually only get £1,000 to help cover the cost of the works.

For a 12 year measure the story was slightly better – the ratio for interest to capital was 40% : 60% – so if you had £70 as the typical annual savings, then the total finance number would be £70 x 12 years = £840.

The interest would account for £336 of the £840, while the remainder would go towards the cost of getting the boiler installed (so £504 in this case).

We have installed hundreds of solid wall insulation jobs across London over the last couple of years and none of them have cost £1,000 – instead you are typically looking at prices starting around the £5,000 mark. Likewise with a boiler, the cost of installing a new one is more like £1,500. So while £500 is a nice help that is still a huge amount of money that needs to be found to get the measure installed.

The worst example of this is for windows, which is why later in the scheme we refused to carry out assessments for people who were simply looking to change their windows. The typical savings on the Green Deal reports were painfully low – which is actually fair enough as replacing windows doesn’t produce huge savings (don’t believe those adverts with the catchy jingles!) – but what this meant in reality is that the Green Deal finance would only cover a fraction of the install cost of the new windows.

There were times it worked though, but typically the house in question needed to be very large, very old and have an ancient heating system – then the amount of finance that could be made available was actually pretty good!

The Set up costs charged by Providers was simply too high!

The other thing that really hurt the Green Deal was if people did decide to go the Green Deal route, they would have to pay a huge setup fee (approximately £300) to get a Green Deal finance plan in place. If you are only borrowing £500 based on limited savings then being whacked by this additional set up fee was always going to hurt.

There were two reasons for these fees – the first was that to become a Green Deal Provider it cost £10,000 so the providers needed to recuperate this initial outlay as a bare minimum. The other reason for these high set up costs relates to the complexity of setting up the finance agreements and the length of time it took to do so. We worked with one provider and it literally took them 4 hours to set up one Green Deal plan and that was provided all the information was in place from the customer.

We also heard that one provider only went live at midday on the day the scheme was scrapped – so spare a thought for them! £10,000 down the drain. We met the communications manager of the Green Deal on numerous occasions and every time he reported how well the scheme was doing so that must of come as a huge blow for that particular provider who had 3 or so hours to make their £10k investment back.

So the Green Deal is dead – lets gaze into the crystal ball!

As far as we can tell, the Green Deal is dead and although ECO is still alive, the Energy companies have met their obligations so there is no money floating around there either.

Personally I feel it may have been too soon to jump from a completely free mechanism (e.g. free cavity wall insulation, loft insulation, boiler etc) to a pay as you save scheme where you could get measures installed but you had to pay back the full cost + interest over the lifespan of the measure like the Green Deal.

In my opinion the scheme would have worked far better if the scheme had been kept ‘in Government’ rather than trying to offer the finance via a private profit making company – this would of meant the loans could have been offered interest free – there were rumours that this would of happened had Labour got into power at the last election.

The lack of finance made available under the Green Deal will also have to be looked at under any new scheme – an opt out button that doesn’t limit the amount of finance might be necessary to ensure people can actually get there energy saving measures fully paid for.

I also think the whole thing needs to be simplified – there were simply too many cogs involved – all trying to take a piece of the pie. The role of providers was in our opinion ridiculous too; these guys weren’t finance bods despite offering finance to households, typically they were just heating engineers or insulation companies. That is not to do them a disservice, but if the same Government team that offered the interest free finance also administered the finance package at a fixed cost then that surely the economies of scale would ensure this cost was kept to a minimum for the end user. Instead of 50 or 100 providers all writing 1-5 Green Deal finance plans each month, they could write the lot. Also the process would then be standardised across the industry – so homeowners could go on to a Government portal and see exactly what they could get for their home.

There should also be a means of encouraging energy efficiency in the UK. The Grant system that was introduced to help push the Green Deal was obviously hugely popular but it did produce a boom and bust feel within the industry. Instead they could incentive people with council tax reductions provided they met certain energy efficiency criteria on their property. i.e. a 5% reduction if they took their starting EPC rate (when they took over the property) up by 10 points – a 10% reduction if it went up 15 points. Obviously that means that the EPC would become much more important, but would also open up the market to fraud as people lodged incorrect details – but that would simply mean more training and also more auditing on behalf of the companies overseeing the EPC lodgements.

The UK has a huge problem with lack of electrical generating capacity that is really going to come to the fore in the next few years, so energy saving and energy efficiency is hugely important as a method of dealing with that. These energy efficiency schemes, like the Green Deal are going to have a huge part to play in helping the UK, but hopefully future schemes will be better thought out!

I hope you have found this an interesting read, but I am sure there are things I have missed or you disagree with so feel free to comment below and let everyone know your thoughts.

Think we missed something? Do you have a different opinion?

Comment below to get your voice heard…

Very interesting article. I am no expert but I do think that it is essential we save energy and that we have a scheme that works. I would suggest the following:

Local Authorities carry out assessments of all buildings in their areas. This assesses the potential for reducing energy consumption and therefore carbon footprint, generating renewable energy and collecting grey water and reusing in the building. This latter measure would help prevent flash flooding as well as reduce water consumption and associated energy costs.

Once a plan has been written estimates from approved providers, all of whom would have to run apprenticeship schemes, would be sought and the plan would then be shared with the home owner. The home owner would not have to implement the plan, but failure to do so would result in a higher council tax bill if the offer of a loan that would cost no more than the savings made was refused.

Who should administer? Local Authorities should assess, gather the estimates and provide the finance. Local Authorities not hitting target would be penalised. All buildings would have to be assessed within a 10 year cycle.

Would this work? Building owners would be incentivised. Local Authorities would be desperate to avoid penalties. Providers of insulation, boilers and heat management systems would be delighted with the huge increase in business and, in those communities where flooding is an issue, such a scheme would be grasped with both hands. Oh, and lets not forget the Government. Falling unemployment? Highly skilled jobs? What’s not to like?

This is exactly why we like people commenting – a far more sensible plan than I came up with in the article above! I think there are some really good ideas there!

One thing I will point out in regards to Keith’s comment – Our local authority doesn’t have money as it is. We had to crowd fund the Christmas lights this year… So doubt it would ever be given the time of day given that all that has been announced recently is cuts.

I would however welcome the plan you suggested! Sounds great!

I have to admit, the main reason I didn’t plump for the green deal was:

1- When it first came out I was getting very confused (mainly the ticks thing you pointed out)

2- The interest seemed astronomical… (Compared to banks)

If both of those were fixed and the WHOLE price of the measure was covered I’d look into it properly!

“Excellent article”

Am I missing something though!

The Green Deal Finance Company (GDFC) insist that the company is, or was solvent. Any monies from the government coffers has been invested into peoples electric meters and paid back each quarter with interest.

The GDFC required another £60m quid to keep funding the scheme. To me being a humble DEA/GDA this was obviously going to happen until the the scheme was established and the money coming back in. Did the financial bods in government not realise this. “We are on the side of hardworking families and businesses – which is why we cannot continue to fund the Green Deal” words of the minister involved with the decision. WHAT! is that comment all about. There has been quite a few billion of tax payers money given to high street bank bailing them out, not to help them invest. What’s a few hundred million in the big scheme of things to help the environment.

The Green Deal was never perfect and required major changes, but still better then what we have now. UNEMPLOYMENT! I must of missed something in my interpretation of the reasons for scrapping of the finance of the scheme. Excuse my ignorance but can anyone explain the real reasons.

Keven

The finance wasnt attractive. Don’t mind borrowing but it has to be competitive. Hopefully any future green deal will be better rolled out in practise.

Interesting article. These aren’t the reasons the scheme didn’t work. They didn’t help, but they weren’t the reason. The main reason is that consumers, on the whole, don’t think the way that businesses or energy saving professionals do. We don’t make purchasing decisions on the rational way presented by the Green Deal. We spend £thousands on things we don’t need but WANT based on identity and self worth – not based on equations and being sensible. We don’t want energy efficiency because it is dull and boring. There is a small niche of consumer who do purchase on the basis of sensible choices and similar pilot scheme have worked in the past because the early adopters to these were from that niche – the schemes were preaching to the converted. Perhaps these consumers are heavily represented amongst engineers and environmentalists which is why these schemes are put forward to Government as viable options.

As an industry, the energy efficiency sector needs to be more honest and realistic about what will and won’t work in terms of realising energy savings. Raising awareness and rational consuming are limited in how much they can ever achieve – to promote these options as viable government policy is counter productive.

The Psyche of the nation has yet to understand Energy savings. The perceived or actual benefit from any incentive specifically if it is free, or partially free will always be viewed with suspicion, even with loaned monies. Many of the above comments make sense. The RHI another incentive has and is being abused, this is costing Government a fortune, for which the Tax Payer is held to ransom to pay huge incomes to the few. This cannot be fair for all! concerned, if we pay huge sums of money to ill judged projects. Government/DECC/Ofgem has created a massive and complex situation, for which we have to pay are paying the Bill.

I looked into the Green Deal details online but couldn’t bring myself to pay for an assessment that might lead nowhere. I applied to my local council for a loan (which would have been interest free) and was assessed for a new boiler and some double glazing. The result was that I was expected to pay £1800 towards work. This was calculated as being what I could afford to borrow. Could I actually borrow this – as a pensioner with an overdraft – no. Dreading the next winter, ten years of freezing since the back boiler died – and counting!

Hatty

You ask “why did the Green Deal fail?” but maybe it didn’t fail; it just depends on whose perspective you take.

From the energy companys’ point of view, the GD was a massive success! More energy being used and a slowdown in the acceleration of the efficiencies that were fitted under the previous supply side subsidy programmes. All this is documented in DUKES.

But for us little people out was a failure. You didn’t mention one thing; the lack of ambition of the GD. CWI and mediocre 2G glazing are not going to take this country’s housing stock forward. Deep retrofit is what is required, and that’s going to take longer term vision that playing about with lending programmes and hand waving interest rates.

Take it from this Green Deal Provider (1North Ltd GDPA297), we are one of the largest GPDs in the UK, the green deal is NOT dead and never has been, I actually welcome the changes that are coming, they were needed. The funding to the GDFC from DECC has stopped.

That is all that has happened. The GD is not government funded, it was never meant to be, what has been said is that the taxpayer should not pay it, I also agree with this.

My personal disappointment was that Amber Rudd did not pull ECO at the same time, as a tax payer and a utility bill payer, I don’t see why I should have to personally pay to improve another individuals property.

The key problem is buried halfway down your point ‘The total finance you get includes the interest on the loan.’ The issue is that the Green Deal’s Golden Rule can only really be met by very few measures – cavity wall insulation, loft insulation and perhaps new boilers. ie the energy savings are hardly ever sufficient to pay for the measure. Pile all the other issues on top of this very weak foundation and the whole thing falls over.

i spent around £20k last summer doing up the house we had just bought, including full new central heating system/combi boiler, electrical rewire, and kitting the house out with as much low power stuff as possible from the outset

so when i read about the green deal, i was excited. i could hopefully get a bit of my outlay back.

but in reality, there were so many hoops to jump through, including only using certain providers (who naturally charged more to cover their overheads) i just didn’t bother in the end. it was all too complicated and convoluted.

if it had’ve been done properly and id’ve actually “saved” a good chunk of money on the final bill, i would have used it to get solar panels installed too, making the house even greener still, but in the end i just didn’t have enough money left. and now, after the feed in tariff cut in January, i’m not even sure it’s worth doing anyway.

it’s almost as if the government didn’t actually want anyone to benefit from this scheme, they just wanted to be *seen* to be making an effort so they could tick off “green initiatives” off their manifesto or something rather than actually wanting to help people be more energy efficient.