Renewable Heat Incentive payments for both ground source and air source heat pumps are calculated using a simple equation. Well, simple if you know what you’re doing.

The Renewable Heat Incentive

The Renewable Heat Incentive, or RHI, was announced in 2008 as part of the Energy Act, although it didn’t come in to effect until 2014. It’s a government subsidy designed to reward smallscale renewable heating systems across England, Scotland and Wales. There’s a commercial arm to it as well, but we’re drilling down on the Domestic RHI in this article.

Heat Pumps

Based on similar technology to air conditioners and freezers, heat pumps use the heat found in air, water or the ground and compress it using electricity. This compression causes the extracted warmth to heat up further and then used for either water or space heating.

Step One: Annual Heat Demand

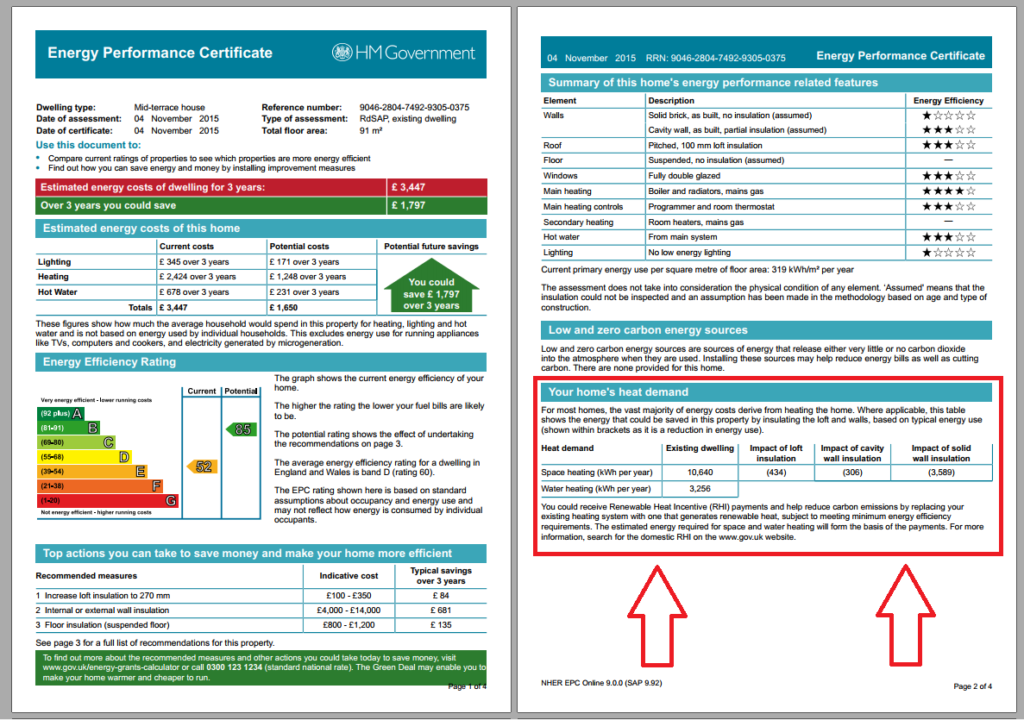

Find the annual space heating and/or hot water demand for your home on your EPC. If you don’t have an EPC, get one now as you’ll need it to apply for the RHI anyway. You can find the section on heat demand towards the bottom of the second page of your EPC.

Depending on whether you’re looking to use your biomass boiler for heating or hot water, you either take the top or bottom number, or add the numbers together if you’re planning to use the boiler for both. The number you’re left with is your home heating demand (measured in kilowatt hours per year, or kWh).

Since 2017, the annual heat demand for RHI heat pump applications has been capped at 30,000 kWh. If your heat demand is above that, your payments will still be calculated on the basis of 30,000 kWh.

Step Two: RHI Tariff Rate

The Renewable Heat Incentive tariffs are not permanently fixed, but rather they are review every 6 months by theDepartment for Business, Energy & Industrial Strategy (BEIS) . This can lead to adjustments, known as degression. Theoretically, degression can alter the tariff by up to 20% in one swift move. There may also be adjustments in line with the Consumer Price Index (CPI), designed to allow for national inflation. However, since the rates were raised at the beginning of 2018 (following the implementation of a heat demand limit), there’s been very little change.

Your payments will be set at the tariff rate that was applicable on the date of your application.

The rates we’re using here are the Renewable Heat Incentive tariff rates, accurate of April 2019.

Step Three: Adjust for the Seasonal Coefficient of Performance (SCoP)

Heat pumps use a certain amount of energy to run, which means that your heat demand needs to be adjusted to take into account the efficiency of the heat pump. This efficiency is called the Seasonal Coefficient of Performance(SCoP) and it’s all to do with how much heat can be generated per unit of electricity; normally it’s between 2.5 and 4. You SCOP score needs to be determined by an MCS installer as part of the installation process.

Divide your annual demand by the Seasonal Coefficient of Performance(SCoP). This will give you a number representing the annual energy consumption of the heat pump.

25,000 / 3.5 = 7,142kWh/yr

Take this annual energy consumption away from your annual heat demand to calculate the renewable proportion of your heat demand.

25,000 – 7,142 = 17,857kWh/yr

It’s this figure that you can claim the RHI on.

Step Four: Calculating Quartlery, Annual, and Total Repayments

So, now that we have all the numbers we need, it’s pretty simple to figure out the payments we can expect.

First we have to divide the tariff rate by 100 to get it into a standard currency format, as opposed to pence. So the ground source rate of 20.89p tariff rate becomes £0.2089, and the air source heat pump rate of 10.71p becomes £0.1071.

Annual Payments:

Multiply the above standard format tariff rate by your annual heat demand. Simple!

Quarterly Payments:

Divide your annual payments by 4.

Total RHI Payments:

Multiply your annual payments by 7.

Examples

We’ve put some examples below of how different heat demands create.

An Air Source Heat Pump with a SCoP of 3.2:

| Building | Heat Demand On EPC | Final Applicable Heat Demand | Quarterly Payment | Annual Payment | Total RHI Payback |

| Small house, good insulation | 6,000 | 4,065 | £108.83 | £435.31 | £3,047.17 |

| Medium house, average insulation | 12,000 | 8,129 | £217.65 | £870.62 | £6,094.34 |

| Large house, poor insulation | 20,000 | 13,548 | £362.76 | £1,451.03 | £10,157.23 |

A Ground Source Heat Pump with a SCoP of 4:

| Building | Heat Demand On EPC | Final Applicable Heat Demand | Quarterly Payment | Annual Payment | Total RHI Payback |

| Small house, good insulation | 6,000 | 4,500 | £235.01 | £940.05 | £6,580.35 |

| Medium house, average insulation | 12,000 | 9,000 | £470.03 | £1,880.10 | £13,160.70 |

| Large house, poor insulation | 30,000 | 22,500 | £1,175.06 | £4,700.25 | £32,901.75 |

Think we missed something? Do you have a different opinion?

Comment below to get your voice heard…

Finally! Somewhere that explains the maths! I keep finding calculators online but none of them explains how they got to the figures they come out with. Really glad to actually understand it now.

Glad we could help, Maria 🙂

Is there any way to calculate your payments if you’re on a metered system?

I am interested in installing a truly hybrid system which is connected to a air heat pump; also able to use a PV solar cell Li batteries to use water electrically. I should like to combine the above elements with a mains gas boiler to supplement heat energy. Can this be done? and is it eligible for RHI grant

Hi Dr Shah,

The PV battery component should not be a problem, but you may find that the duel-heating system gives you issues. I’d advise that you take a look at this article here and Ofgem guidelines here. If neither of those give you the answers you require, it would be worth giving Ofgem a call – their domestic RHI line is 0300 003 0744.

Best,

Harri

Thanks for this – we called the energy saving trust and they were absolutely useless! Took ages to spek to a human, and then they had no idea what they were talking about

i think my rhi payments are incorrect. if i understand the maths correctly, i think i’m not getting as much as i should. is it BEIS that deals with this?

It’s unlikely that the payments are wrong, it’s worked out like described above, so it’s kind of impossible for that simple calcuation to be wrong…

Hi Helena,

Actually it’s Ofgem that handle the RHI. You can reach them at domesticrhi@ofgem.gov.uk and they should be able to help you out.

Thanks!

H

Hi. The maths here seems to imply that if you don’t improve the insulation of your house, you get more cash back from the RHI. Is that correct? Is there not a minimum amount of insulation that you have to do in order to qualify for the RHI? Can you really get it with a poorly insulated house? Thanks.

Hi – the issue is that while the heat demand of the property is higher in an uninsulated house and therefore you do get higher heat pump payments, you are also having to pay more as you require more heat to keep the place warm!

is this based on the estimate or actual usage. So if my predicted needs are X and my payments are based on that, what will happen if I actually use less in real life? Will my real payments be reduced?

Hi, I am willing to know the how you have calculated the Heat Demand on EPC and final applicable Heat Demand because I am not getting any option to find it from consumption and heating costs data. Thanks