The Renewable Heat Incentive (RHI) is a government-run scheme designed to get more people investing in renewable energy.

There are thousands of eligible product models eligible to claim the RHI, as long as they follow certain rules. Here we’ll let you know more about what does and doesn’t make the cut.

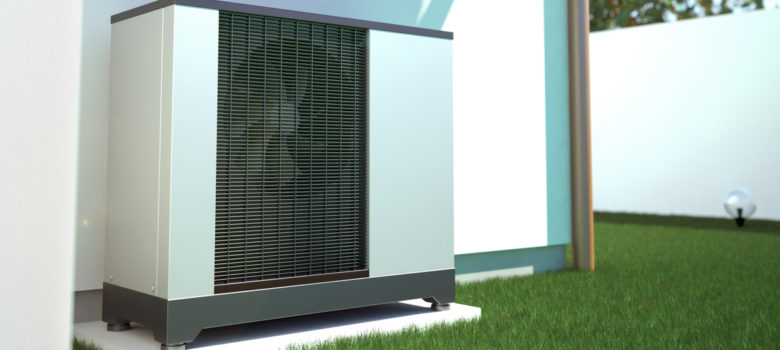

Is my air source heat pump eligible for the RHI?

To qualify for the RHI, your air source heat pump needs to be situated in England, Wales or Scotland. Northern Ireland has its own RHI scheme – you can find out more here. You need an EPC that is less than 2 years old, and that reflects any recent construction. If cavity and/or loft insulation is recommended on the EPC, you’ll be rejected from the scheme until you get these installed.

If your air source heat pump was installed as part of a new build, it’s very unlikely to be eligible for the RHI. There is an exception for “custom builds” – you can find out more about that here.

The air source heat pump itself must be new to be eligible. Don’t worry if your radiators and pipes and whatnot aren’t new, it’s the heat generating element that needs to be (in this case, the pump).

You can claim the RHI on one space heating system, like an air source heat pump, as well as one domestic hot water supply (solar thermal). The rules around having more than one space heating system in your property is a little more complicated. You can find out more here.

The heat pump itself is required to have been installed by an MCS accredited installer, as you’ll need your MCS certificate. On that certificate, there will be a Seasonal Performance Factor (SPF). This number must be a minimum of 2.5.

The MCS certificate will also be used to determine when the heat pump was installed. To be eligible for the RHI it has to have been installed within the last 12 months. That means no more than 12 months between the date of installation on that certificate, and the date on your application.

The heat pump itself cannot be an air-to-air heat pump, these are not supported. To be eligible, the air source heat pump must use a liquid to provide space heating. The compressor of your heat pump must also be driven by electricity. Most of them are, so if you’re not sure then in all likelihood yours is.

The last big restriction is that your air source heat pump must be compliant with the Ecodesign of Energy-related Products (ErP) Directive. This is a fairly complicated framework which sets mandatory ecological requires for products in the EU. It’s very unlikely that you would have an air source heat pump that passes all the other eligibility criteria but fails this one.

You can download the full list of eligible air source heat pump models here.

Will my air source heat pump need to be metered?

As a rule, air source heat pump RHI payments are determined by the annual heat demand on your EPC. That said, for all heat pumps you do need electricity metering arrangements, even if your payments aren’t based on this.

There are certain situations in which your final RHI payments WILL be based on these meter readings. You’ll need metered readings if either of the following applies:

- You have another heating system installed on the property

- The property is occupied for less than half of the year

How much will my air source heat pump RHI payments be?

For details on how to figure out what your RHI payments will be, you can read our full breakdown here.

Think we missed something? Do you have a different opinion?

Comment below to get your voice heard…

Hello,

I’m looking to install a heat pump in my newquay residence later this year. My preferred choice is an air to air system but I’m frustrated to learn that only those heat pumps that turn their renewable energy into liquid rather than air are eligible. Can someone please explain what the thinking is here? The Mitsubishi unit I’m looking at has a SCOP of 4.7 and an ERP of A++ in heating mode. Heat pumps need to meet a min of 2.5 SCOP Accor to the RHI a number that the Mitsubishi obliterates so…? Anyone?

Are RHI payments counted as taxable income by HMRC please?

My domestic RHI for biomass comes to an end next year. (When) can I apply for RHI for an AIR source (or ground source) heat pump?